Recover Cash Faster with AI-Driven Credit Management

Dunning scenarios, automated reminders (email/SMS/call/print), Reports, KPIs & forecasting — in one place.

Dunning scenarios, automated reminders (email/SMS/call/print), Reports, KPIs & forecasting — in one place.

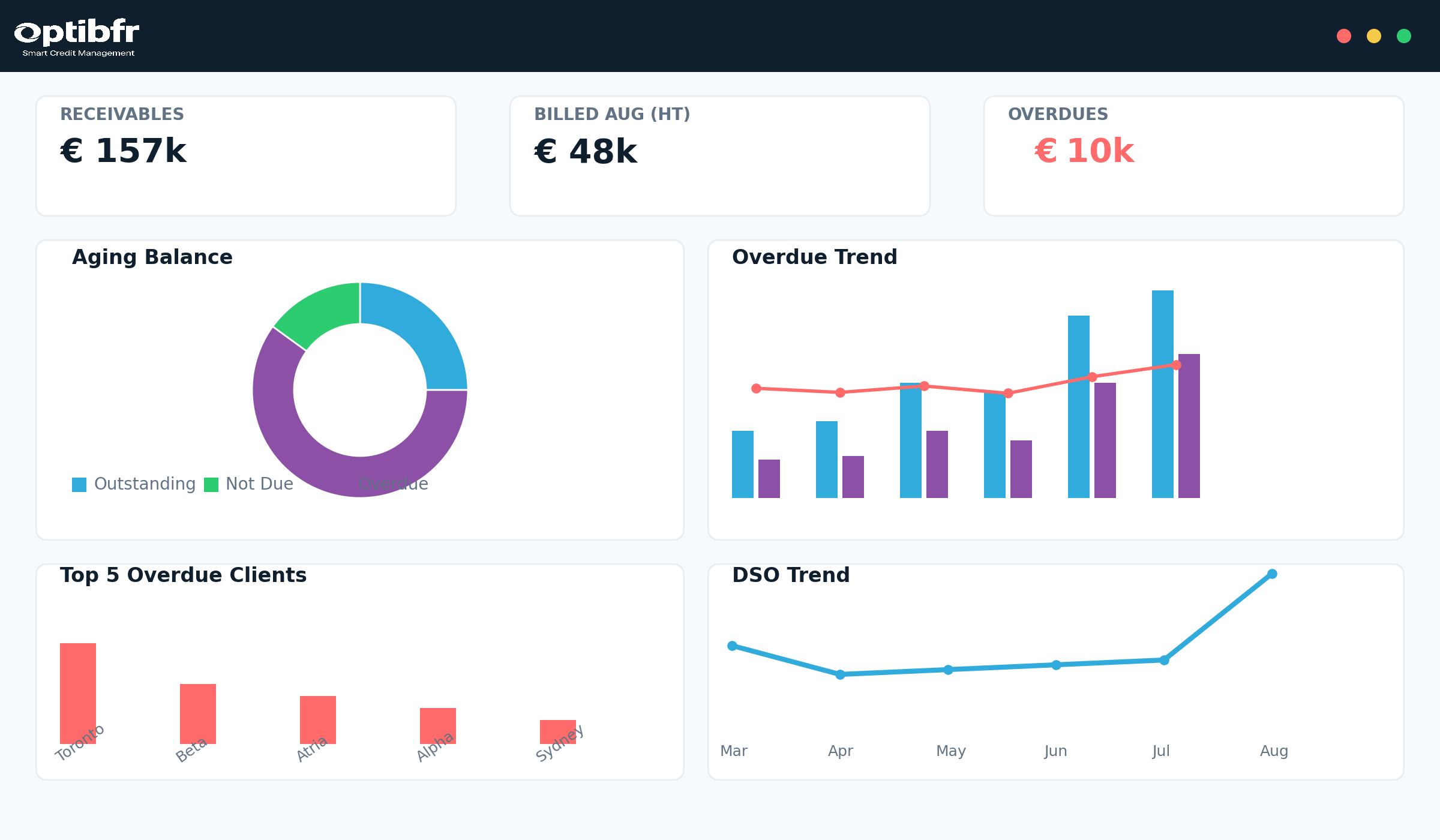

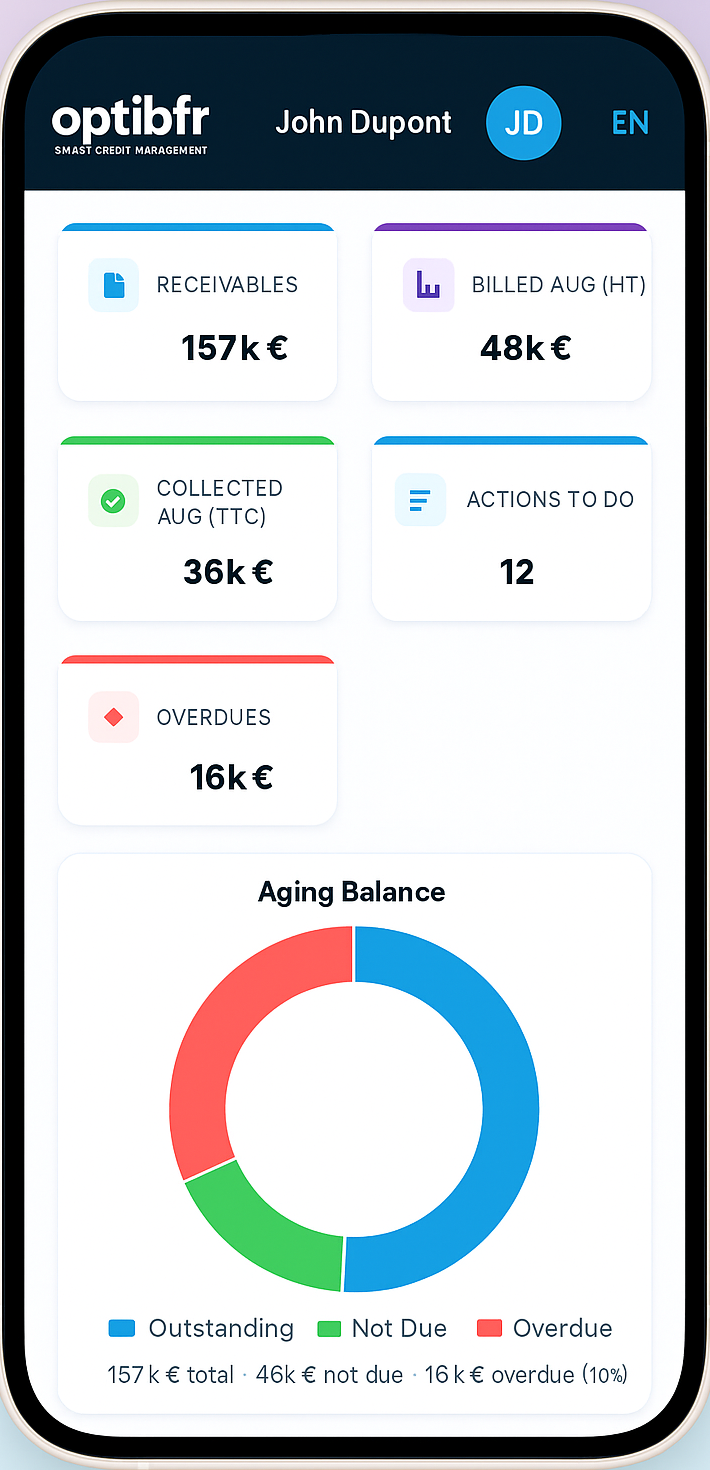

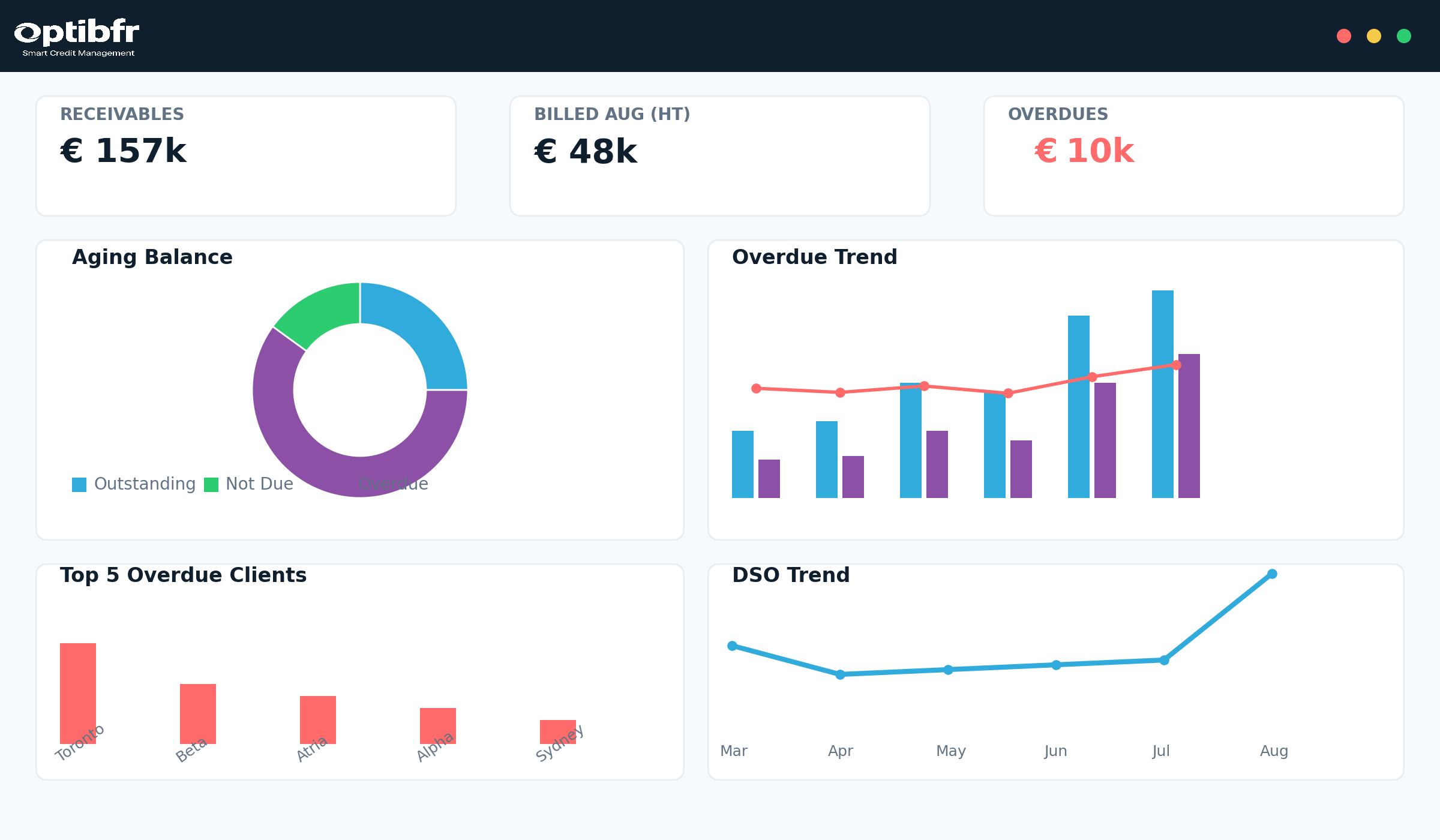

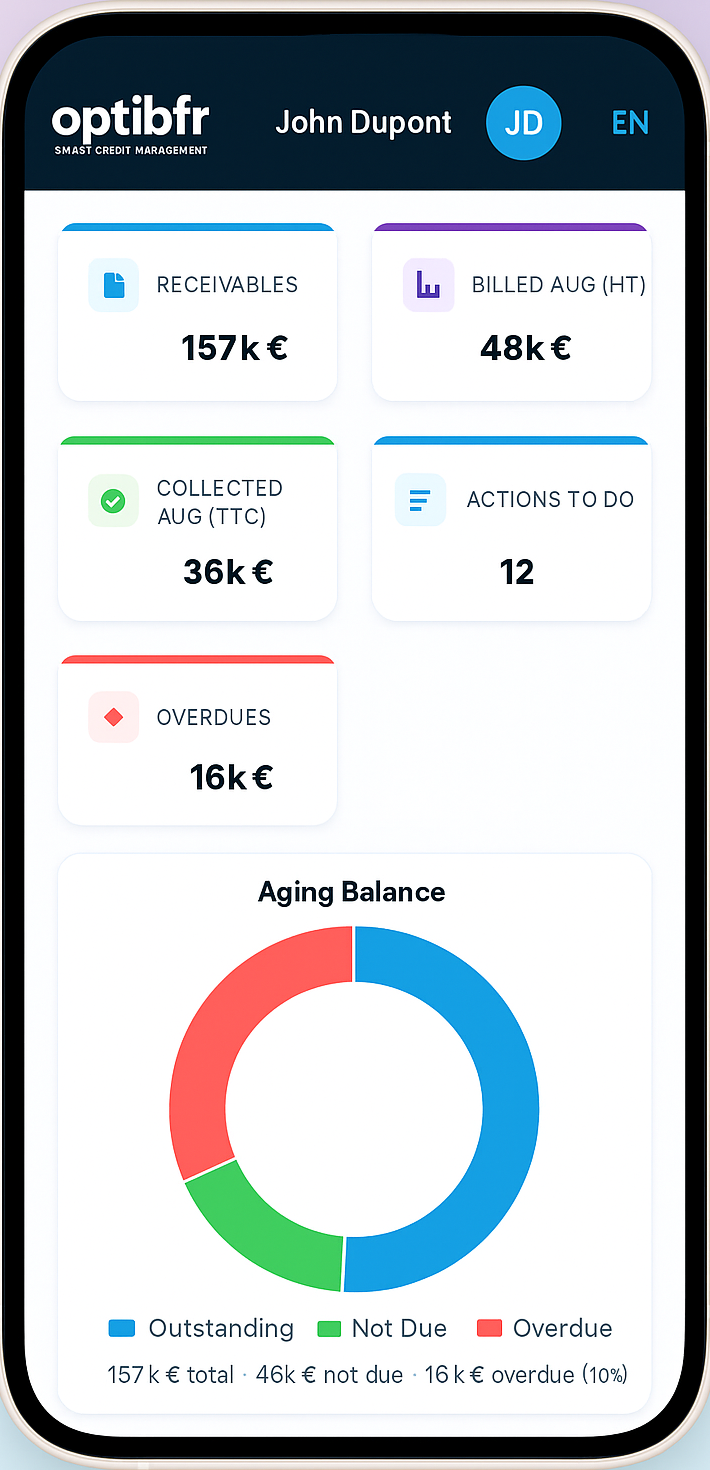

Three views your AR team will live in every day.

OptiBFR unifies invoicing, consolidation, and credit management in one intelligent workspace — giving CFOs, Credit Managers and Controllers full visibility and control across all entities.

Manage both traditional and project-based billing workflows. Link invoices to milestones, track budgets, apply taxes, and generate consolidated invoice batches across subsidiaries. OptiBFR’s invoicing module integrates directly with your ERP or accounting software.

Visualize group performance at a glance. OptiBFR consolidates aging, cash forecasts and DSO across all your companies, while preserving local data structures and currencies for each entity.

Automate FX conversions in real time. Every dashboard, invoice and report reflects the correct rate for its transaction date — ensuring precise group reporting in EUR, USD, GBP or any global currency.

Anticipate and mitigate late payments. From automated reminders to dispute tracking and legal escalation, OptiBFR structures the entire collection and litigation process while keeping customer relationships under control.

AI-assisted collections, scenario-driven reminders and enterprise-grade security in a single platform.

Optimal channel & timing suggestions, personalized reminders, and smarter follow-ups to lift recovery rates.

Design multi-step strategies (email/SMS/call/print), with offsets, windows, and auto/manual steps per client.

EU hosting, encryption, access control, and detailed audit logs to keep your data safe and compliant.

Native connectors + file/SFTP — go live without a heavy IT project.

From import to impact in minutes — no heavy IT project.

Map your data from ERP/accounting or upload files; OptiBFR cleans and reconciles automatically.

Set steps, channels, day offsets and templates; toggle auto-send per step or per client.

AI scoring, KPIs, DSO trend, dispute tracking and cash-flow forecasting help you iterate fast.

Bank-grade practices by default.

Encryption at rest & in transit, RBAC, audit trails and granular permissions.

Hosted in the EU with retention policies aligned with compliance needs.

Pay as you grow with plans designed for startups and enterprises alike.